As Top 5 Commercial Insurance Carriers for Small Business LLCs in the US (Coverage & Cost Review) takes center stage, this opening passage beckons readers with engaging insights into the world of commercial insurance. With a focus on coverage and cost, this discussion promises to offer valuable information for small business LLCs looking to protect their interests effectively.

Overview of Commercial Insurance for Small Business LLCs

Commercial insurance plays a crucial role in protecting small business LLCs from various risks and liabilities. It provides financial coverage in case of unexpected events that could potentially harm the business. There are different types of commercial insurance available to small business LLCs, each serving a specific purpose and providing coverage for different aspects of the business.

Types of Commercial Insurance Available

- General Liability Insurance: This type of insurance protects small business LLCs from claims of bodily injury, property damage, and advertising injury.

- Property Insurance: Property insurance covers the physical assets of the business, such as buildings, equipment, and inventory, in case of damage or loss due to fire, theft, or other covered events.

- Professional Liability Insurance: Also known as errors and omissions insurance, this coverage protects small business LLCs from claims of negligence or inadequate work.

- Workers' Compensation Insurance: This insurance is mandatory for businesses with employees and provides coverage for medical expenses and lost wages in case of work-related injuries or illnesses.

Scenarios where Commercial Insurance Can Protect Small Business LLCs

- If a customer slips and falls in the business premises, general liability insurance can cover the medical expenses and legal fees associated with the claim.

- In the event of a fire damaging the business property, property insurance can help cover the cost of repairs or replacement of the damaged assets.

- If a client sues the business for alleged negligence in the services provided, professional liability insurance can cover the legal defense costs and any settlement fees.

- If an employee gets injured on the job, workers' compensation insurance can cover their medical expenses and lost wages, reducing the financial burden on the business.

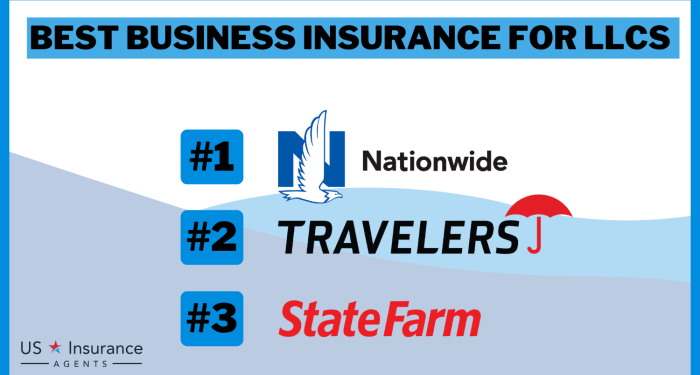

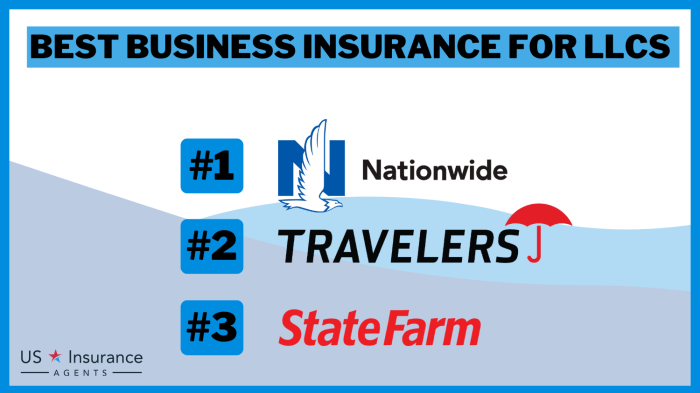

Top 5 Commercial Insurance Carriers in the US

When it comes to commercial insurance options for small business LLCs in the US, there are several top carriers that stand out in terms of coverage and cost. Let's take a look at the top 5 commercial insurance carriers and the coverage options they offer.

1. State Farm

State Farm is a well-known insurance provider that offers a range of coverage options for small business LLCs. They provide general liability insurance, property insurance, and commercial auto insurance, among others. State Farm is known for its reliable customer service and comprehensive coverage options.

2. Allstate

Allstate is another popular choice for small business insurance. They offer coverage options such as business owners policy (BOP), workers' compensation insurance, and cyber liability insurance. Allstate is known for its customizable policies and competitive rates.

3. Nationwide

Nationwide is a trusted insurance carrier that offers a variety of coverage options for small business LLCs. Their offerings include professional liability insurance, commercial umbrella insurance, and business interruption insurance. Nationwide is known for its financial strength and flexible coverage options.

4. Farmers Insurance

Farmers Insurance is a well-established insurance provider that caters to the needs of small businesses. They offer coverage options such as commercial property insurance, inland marine insurance, and employment practices liability insurance. Farmers Insurance is known for its personalized service and quick claims processing.

5. Liberty Mutual

Liberty Mutual is a reputable insurance carrier that provides tailored insurance solutions for small business LLCs. Their coverage options include commercial auto insurance, professional liability insurance, and cyber risk insurance. Liberty Mutual is known for its innovative insurance products and strong financial stability.

Cost Analysis of Commercial Insurance for Small Business LLCs

Commercial insurance premiums for small business LLCs can vary based on several factors, including the type of coverage needed, the size and nature of the business, location, claims history, and industry risks. Understanding how these factors influence the cost of commercial insurance is crucial for small business owners looking to protect their assets and operations.

Factors Influencing Commercial Insurance Costs

- Business Size and Nature: Larger businesses with more employees and higher revenues may face higher premiums due to increased risk exposure.

- Location: Businesses located in areas prone to natural disasters or with higher crime rates may pay more for insurance coverage.

- Claims History: A history of frequent or costly insurance claims can lead to higher premiums as insurers perceive the business as a higher risk.

- Industry Risks: Some industries, such as construction or healthcare, are inherently riskier and may face higher insurance costs.

Premium Calculation Breakdown

Commercial insurance premiums are typically calculated based on the following factors:

- Business size, revenue, and assets

- Type and amount of coverage needed

- Risk factors associated with the business

- Claims history and likelihood of future claims

- Location of the business

Comparison of Pricing Structures

When comparing the pricing structures of the top 5 commercial insurance carriers for small business LLCs, it's essential to consider the coverage options offered, deductibles, limits, and any additional services included in the policy. Each insurance carrier may have its own unique pricing model, so it's crucial for small business owners to obtain multiple quotes and evaluate the cost and coverage offered by each carrier before making a decision.

Customer Satisfaction and Reviews

Customer satisfaction ratings and reviews play a crucial role in helping small business LLCs make informed decisions when choosing an insurance carrier. By examining feedback from existing customers, businesses can gain insights into the quality of service, claim processing efficiency, and overall customer experience offered by each insurance provider.

Customer Feedback for Top 5 Commercial Insurance Carriers

- State Farm: Many customers appreciate State Farm's responsive customer service and quick claims processing. However, some have raised concerns about premium increases.

- Allstate: Customers praise Allstate for its comprehensive coverage options and competitive rates. On the downside, a few customers have reported delays in claim settlements.

- Progressive: Positive reviews for Progressive often highlight the user-friendly online platform and customizable policy options. Some customers have complained about communication issues with claims representatives.

- Liberty Mutual: Liberty Mutual receives praise for its extensive coverage offerings and knowledgeable agents. However, some customers have mentioned difficulties in reaching customer support during peak times.

- Nationwide: Customers appreciate Nationwide's personalized service and strong financial stability. A few customers have expressed dissatisfaction with the claim resolution process.

Epilogue

In conclusion, the exploration of the top commercial insurance carriers for small business LLCs in the US sheds light on crucial aspects such as coverage options, costs, and customer satisfaction. By weighing these factors carefully, businesses can make informed decisions to safeguard their operations and assets.

FAQs

What factors can influence the cost of commercial insurance for small business LLCs?

The factors can include the type of coverage needed, the size of the business, the location, and the industry risks involved.

How are premiums calculated for commercial insurance policies?

Premiums are calculated based on factors like the level of coverage, the business's risk profile, claims history, and the chosen insurance carrier's pricing structure.

How can customer feedback assist small business LLCs in choosing an insurance carrier?

Customer feedback provides insights into the quality of service, claims handling, and overall satisfaction levels, helping businesses make informed decisions.