Delving into State Farm Auto Insurance Quote Guide: How to Get the Lowest Rate in Florida (2026 Discounts), this introduction immerses readers in a unique and compelling narrative, with a casual formal language style that is both engaging and thought-provoking from the very first sentence.

Exploring the various aspects of State Farm Auto Insurance in Florida, this guide aims to provide valuable insights for individuals seeking the best rates and coverage options in 2026.

Background on State Farm Auto Insurance in Florida

State Farm Auto Insurance plays a crucial role in Florida, providing residents with reliable coverage and peace of mind on the road. With a wide range of policies and options, State Farm is a popular choice for drivers in the Sunshine State.

Key Features and Benefits of State Farm Auto Insurance

- Customizable coverage options to suit individual needs and budgets.

- 24/7 customer support for assistance with claims and policy inquiries.

- Discounts for safe driving, bundling policies, and more to help save money.

- Quick and efficient claims processing to get you back on the road as soon as possible.

State Farm’s Presence and Reputation in Florida

State Farm has a strong presence in Florida, with numerous local offices and agents across the state. Known for its reliable service and competitive rates, State Farm has built a solid reputation among Florida drivers. Whether you're in Miami, Orlando, or anywhere in between, State Farm is a trusted name in auto insurance.

Factors Affecting Auto Insurance Rates in Florida

When it comes to auto insurance rates in Florida, several key factors play a significant role in determining how much you'll pay for coverage. Factors such as your location, driving record, vehicle type, and coverage options all impact the premiums you'll be quoted.

Additionally, age, gender, and credit score can also influence how much you'll pay for auto insurance in Florida.

Location

Your location in Florida can have a big impact on your auto insurance rates. Urban areas with higher population densities tend to have more traffic congestion and higher rates of accidents, leading to higher insurance premiums. Additionally, areas prone to extreme weather events or high crime rates may also see higher insurance costs.

Driving Record

Your driving record is one of the most important factors that insurance companies consider when determining your rates. A clean driving record with no accidents or traffic violations will typically result in lower premiums, while a history of accidents or moving violations can lead to higher rates.

Vehicle Type

The type of vehicle you drive can also affect your auto insurance rates. Generally, newer and more expensive cars will cost more to insure, as they can be more costly to repair or replace. On the other hand, older or less expensive vehicles may come with lower insurance premiums.

Coverage Options

The coverage options you choose for your auto insurance policy will also impact your rates. Opting for higher coverage limits or additional coverage options like comprehensive and collision coverage will increase your premiums, while choosing the minimum required coverage will result in lower costs.

Age, Gender, and Credit Score

Factors such as your age, gender, and credit score can also influence how much you'll pay for auto insurance in Florida. Younger drivers and male drivers tend to pay higher premiums, as they are statistically more likely to be involved in accidents.

Additionally, drivers with lower credit scores may also see higher insurance rates, as credit history is often used as a factor in determining insurance premiums.

Discounts Offered by State Farm in Florida

When it comes to saving money on auto insurance with State Farm in Florida, there are several discounts available to help lower your premiums. These discounts can be based on a variety of factors, such as your driving record, the safety features in your vehicle, and even where you live in Florida.

Multi-Line Discount

If you have multiple insurance policies with State Farm, such as auto and homeowners insurance, you may qualify for a multi-line discount. By bundling your policies together, you can save money on both premiums.

Safe Driving Discount

Having a clean driving record with no accidents or traffic violations can qualify you for a safe driving discount. This discount rewards responsible drivers who follow the rules of the road and maintain a good driving history.

Vehicle Safety Features Discount

If your vehicle is equipped with safety features such as anti-lock brakes, airbags, and anti-theft devices, you may be eligible for a discount on your auto insurance. These features can help reduce the risk of accidents and theft, leading to lower premiums.

Good Student Discount

Students who maintain good grades in school may qualify for a good student discount with State Farm. This discount rewards young drivers for their academic achievements and responsible behavior, leading to potential savings on auto insurance.

Tips for Getting the Lowest Rate on State Farm Auto Insurance in Florida

To ensure you get the best possible rate on your State Farm auto insurance in Florida, follow these tips to maximize discounts and customize coverage to fit your needs while keeping costs low.

Step-by-Step Guide to Obtaining a Quote from State Farm in Florida

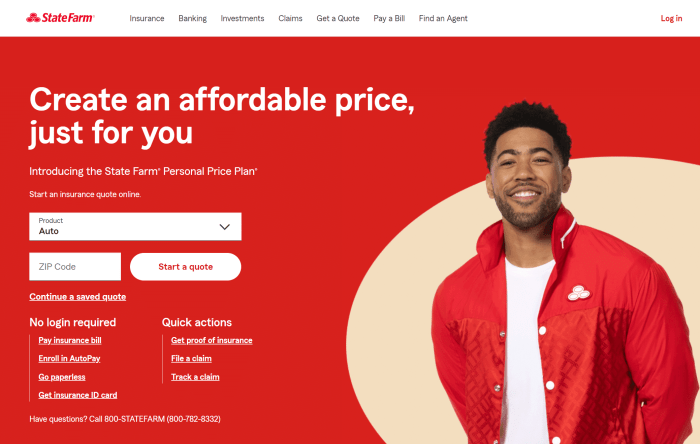

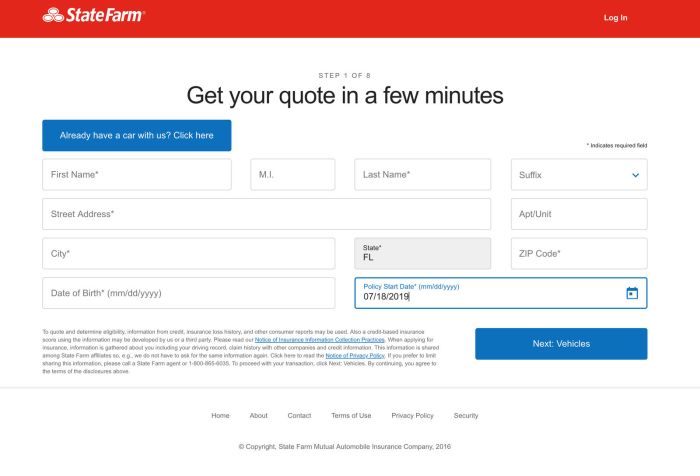

- Visit the State Farm website or contact a local agent to request a quote.

- Provide accurate information about your vehicle, driving history, and coverage needs.

- Review the quote carefully to understand the coverage options and associated costs.

- Ask about available discounts and ways to further reduce your premium.

Strategies for Maximizing Discounts and Reducing Premium Costs

- Bundle your auto insurance with other policies, such as homeowners or renters insurance.

- Take advantage of discounts for safe driving habits, like having a clean driving record or completing a defensive driving course.

- Consider increasing your deductible to lower your premium, but make sure you can afford the out-of-pocket cost if you need to file a claim.

- Regularly review your coverage needs and adjust your policy to eliminate any unnecessary coverage that may be driving up costs.

Tips on Customizing Coverage to Fit Individual Needs

- Opt for higher liability limits if you have valuable assets to protect in the event of a serious accident.

- Add comprehensive and collision coverage if you have a newer vehicle that would be costly to repair or replace.

- Consider adding roadside assistance or rental car reimbursement coverage for added peace of mind.

- Ask your agent about any available discounts for specific safety features on your vehicle, such as anti-theft devices or anti-lock brakes.

Customer Experience and Reviews

When it comes to State Farm Auto Insurance in Florida, customer experience and reviews play a crucial role in shaping perceptions of the company. Positive feedback can highlight the insurer's strengths, while negative reviews can shed light on areas for improvement.

Customer Testimonials

- Many State Farm customers in Florida have praised the company for its responsive customer service representatives who are knowledgeable and helpful.

- Customers have also appreciated the ease of filing claims and the efficiency with which State Farm processes them.

- Some policyholders have mentioned the convenience of managing their policies online through the State Farm website or mobile app.

Feedback Themes

- Positive themes include quick claims processing, friendly customer service, and a user-friendly online platform for policy management.

- On the other hand, negative feedback often revolves around premium increases, especially after filing claims, and occasional delays in claims settlement.

- Some customers have also expressed dissatisfaction with communication from State Farm regarding policy changes or updates.

Impact on Customer Satisfaction

- State Farm's customer service and claims handling have a direct impact on customer satisfaction in Florida.

- Efficient and empathetic claims handling can enhance customer loyalty and trust in the insurer.

- On the contrary, poor communication or delayed claims processing can result in frustration and dissatisfaction among policyholders.

Final Thoughts

In conclusion, navigating the world of auto insurance can be complex, but with the right information and strategies, obtaining the lowest rate on State Farm Auto Insurance in Florida is within reach. By following the tips Artikeld in this guide, individuals can make informed decisions to protect their vehicles and finances effectively.

Quick FAQs

What is the importance of State Farm Auto Insurance in Florida?

State Farm Auto Insurance in Florida provides essential coverage for drivers, offering protection against financial losses in the event of accidents or unforeseen circumstances on the road.

How can bundling policies or having a safe driving record lead to discounts?

Bundling policies allows customers to combine multiple insurance products with one provider, leading to cost savings. A safe driving record demonstrates responsible behavior on the road, which can qualify individuals for discounts.

What impact does age, gender, and credit score have on auto insurance premiums?

Age, gender, and credit score can influence auto insurance premiums, with younger drivers typically facing higher rates, while individuals with good credit may be eligible for lower premiums. Gender may also play a role in determining insurance costs.