Starting off with General Liability Insurance Costs in New York City: Price Benchmarks for Contractors & Retailers, this introductory paragraph aims to grab the readers' attention and provide a brief overview of the topic.

It will set the stage for a detailed discussion on the coverage, costs, and importance of general liability insurance for businesses in NYC.

Overview of General Liability Insurance Costs in New York City

General liability insurance is crucial for contractors and retailers in New York City as it provides coverage for various risks and liabilities that may arise in the course of their business operations. This type of insurance protects businesses from financial losses due to third-party bodily injury, property damage, advertising injury, and legal expenses.

Examples of Potential Risks Covered

- Property damage: If a contractor accidentally damages a client's property while working on a project, general liability insurance can cover the costs of repair or replacement.

- Bodily injury: In case a customer slips and falls in a retail store, general liability insurance can help cover medical expenses and legal fees if the customer decides to sue.

- Advertising injury: If a retailer is accused of copyright infringement or false advertising, general liability insurance can provide coverage for legal defense costs.

Importance of General Liability Insurance for Businesses in NYC

Having general liability insurance is essential for businesses in New York City due to the high costs associated with legal claims and lawsuits. Without this coverage, businesses risk facing financial ruin in the event of a lawsuit or liability claim.

In a litigious environment like NYC, where lawsuits are common, general liability insurance provides a safety net for businesses to protect their assets and reputation.

Factors Influencing General Liability Insurance Costs

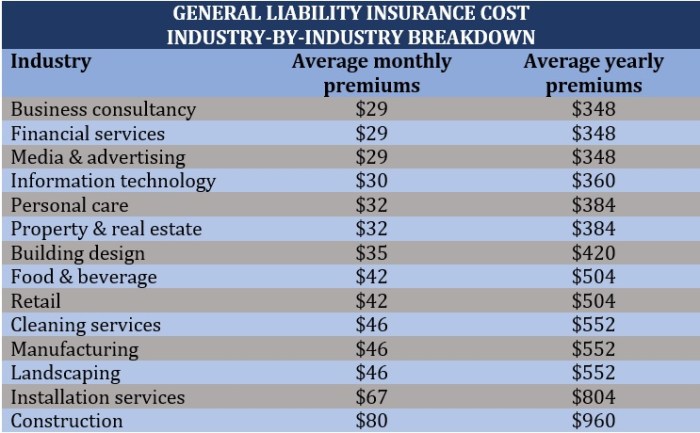

When it comes to determining general liability insurance costs in New York City, several key factors come into play. These factors can significantly impact the premiums that contractors and retailers have to pay for coverage.

Business Size and Type

The size and type of business are crucial factors that influence insurance costs. Larger businesses with more employees and higher revenues may face higher premiums due to the increased risk of potential claims. Additionally, the type of business, such as construction contractors versus retail stores, can also impact insurance pricing.

Businesses in high-risk industries may have higher premiums compared to those in low-risk sectors.

Past Claims History

Another important factor that can affect insurance pricing is the past claims history of a business. Insurers typically take into account any previous liability claims filed by the business when calculating premiums. A history of frequent or costly claims can lead to higher insurance costs, as it indicates a higher risk of future claims.

On the other hand, a clean claims history may result in lower premiums for businesses.

Price Benchmarks for Contractors

When it comes to general liability insurance costs for contractors in New York City, the premiums can vary based on the type of contractor and the level of risk associated with their work. Understanding the average insurance costs for different types of contractors can help contractors budget effectively and make informed decisions.

Types of Contractors and Average Insurance Costs

| Contractor Type | Average Insurance Cost |

|---|---|

| Plumbers | $1,200

|

| Electricians | $1,500

|

| Construction Companies | $2,000

|

Factors Influencing Insurance Costs for Contractors

- Level of risk associated with the type of work: Contractors engaged in high-risk activities such as construction may have higher premiums.

- Claims history: Contractors with a history of frequent claims may face higher insurance costs.

- Business size: The size of the contractor's business can also impact insurance costs, with larger businesses typically paying more.

- Location: Contractors operating in New York City may face higher insurance costs due to the increased risk of lawsuits in a densely populated urban area.

Price Benchmarks for Retailers

When it comes to general liability insurance costs for retailers in New York City, the premiums can vary significantly based on several factors. Let's take a closer look at the average premiums for different types of retailers and the factors that influence these rates.

Grocery Stores

Grocery stores typically face higher liability risks due to the nature of their business, which involves handling food products and dealing with a high volume of foot traffic. On average, a grocery store in New York City can expect to pay between $500 to $2,000 per month for general liability insurance coverage.

Clothing Boutiques

Clothing boutiques generally have lower liability risks compared to grocery stores, as they do not deal with perishable goods or heavy foot traffic. The average monthly premium for general liability insurance for a clothing boutique in NYC ranges from $300 to $800.

Electronics Shops

Electronics shops face unique risks related to the sale of expensive and sometimes fragile products. As a result, the average monthly premium for general liability insurance for an electronics shop in New York City can range from $400 to $1,200.

Factors Influencing Insurance Rates

Several factors can influence the insurance rates for retailers, including the location of the store, the size of the business, the number of employees, the level of coverage needed, and the claims history. Retailers located in high-crime areas or areas prone to natural disasters may face higher insurance premiums due to increased risk.

Final Review

Concluding our discussion on General Liability Insurance Costs in New York City: Price Benchmarks for Contractors & Retailers, this summary paragraph encapsulates the key points discussed and leaves readers with a lasting impression of the topic.

Essential Questionnaire

What does general liability insurance cover for contractors and retailers?

General liability insurance typically covers bodily injury, property damage, and advertising injury claims that a business may face.

How can the size and type of business impact insurance premiums in NYC?

The size and type of business can influence insurance premiums as larger businesses with more exposure to risk may have higher premiums compared to smaller businesses.

Why is general liability insurance essential for businesses in NYC?

Having general liability insurance is crucial for businesses in NYC to protect themselves against potential lawsuits, accidents, or other unforeseen events that could result in financial losses.