Best Business Insurance for LLCs: Bundled General Liability + Professional Indemnity Policies (US) sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with a casual formal language style and brimming with originality from the outset.

As we delve into the intricacies of LLC business insurance, exploring the significance of general liability and professional indemnity policies bundled together, a comprehensive understanding of the topic unfolds.

Introduction to LLC Business Insurance

LLC business insurance is a type of coverage specifically designed for Limited Liability Companies (LLCs). It provides financial protection for the business and its owners in case of unforeseen circumstances.

Importance of Having Insurance for LLCs

Having insurance for LLCs is crucial as it helps protect the business from potential risks and liabilities. In the event of a lawsuit or property damage, insurance can cover legal fees, medical expenses, and other costs that could otherwise cripple the business.

Scenarios Where LLC Insurance is Beneficial

- Professional Indemnity Insurance: This type of coverage is essential for LLCs that provide professional services, such as consulting or legal advice. It protects the business from claims of negligence, errors, or omissions in the services provided.

- General Liability Insurance: General liability insurance covers the LLC against claims of bodily injury, property damage, or advertising injury. This coverage is important for businesses that interact with clients or the public on a regular basis.

- Property Insurance: Property insurance protects the physical assets of the LLC, such as buildings, equipment, and inventory, from events like fire, theft, or natural disasters.

General Liability Insurance for LLCs

General liability insurance is a type of coverage that protects businesses from financial losses resulting from claims of injury or damage caused to others by the business operations or products. This insurance typically covers legal fees, medical expenses, property damage, and settlements or judgments.

Coverage Provided by General Liability Insurance

- Third-party bodily injury: If a customer slips and falls in your office or store and gets injured, general liability insurance can cover their medical expenses.

- Third-party property damage: If your business accidentally damages someone else's property, this insurance can help cover the costs of repairs or replacement.

- Advertising injury: This coverage can protect your business against claims of libel, slander, copyright infringement, or other forms of advertising-related harm.

Professional Indemnity Insurance for LLCs

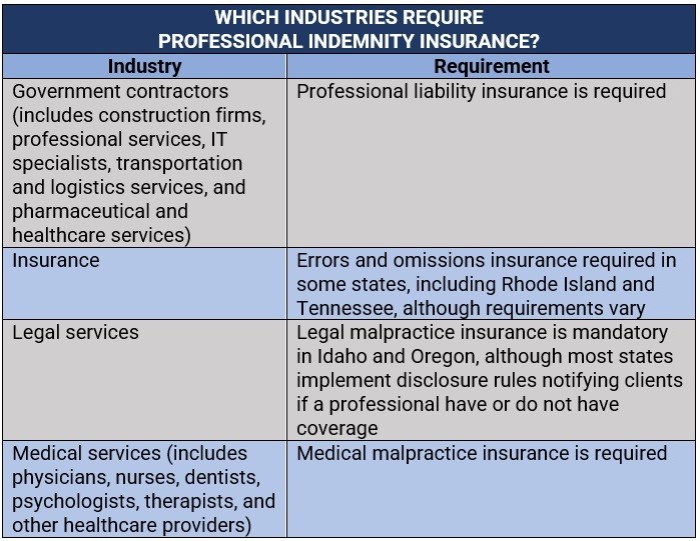

Professional indemnity insurance, also known as professional liability insurance, is a type of coverage that protects businesses, including LLCs, against claims of negligence or inadequate work performance.

Significance of Professional Indemnity Insurance

Professional indemnity insurance is crucial for LLCs as it provides financial protection in case a client alleges errors, omissions, or negligence in the services provided by the business. This coverage can help cover legal expenses, settlements, or judgments that may arise from such claims.

Comparison with General Liability Insurance

While general liability insurance covers bodily injury, property damage, and advertising injury claims, professional indemnity insurance specifically focuses on claims related to professional services. General liability insurance may not cover claims of professional negligence, making professional indemnity insurance essential for LLCs offering professional services.

Scenarios where Professional Indemnity Insurance is Crucial

- When a client alleges that the LLC's services caused financial harm or failed to meet expectations.

- In cases where a mistake or oversight by the LLC leads to a client suffering losses.

- If a client claims that the LLC provided inadequate advice or recommendations that resulted in a negative outcome.

Benefits of Bundling General Liability and Professional Indemnity Policies

When it comes to protecting your LLC, bundling general liability and professional indemnity policies can offer numerous advantages. Not only does it provide comprehensive coverage, but it can also help save costs for LLC owners in the long run.

Advantages of Bundling Policies

- Bundling general liability and professional indemnity policies can result in a more cost-effective solution compared to purchasing them separately. Insurance companies often offer discounts for bundled policies, helping LLC owners save money.

- By combining these two types of insurance, LLCs can enjoy broader coverage that addresses a wider range of risks. General liability protects against bodily injury and property damage claims, while professional indemnity covers errors, negligence, and omissions in professional services.

- Having bundled policies simplifies the insurance process for LLC owners, as they only need to deal with one insurance provider and policy. This streamlines the management of insurance coverage and claims, making it more efficient for the business.

Last Recap

In conclusion, the amalgamation of general liability and professional indemnity policies presents a robust shield for LLCs, safeguarding their interests and assets in a dynamic business landscape. This comprehensive coverage not only mitigates risks but also fosters a secure environment for entrepreneurial endeavors to thrive.

FAQ

What does LLC business insurance entail?

LLC business insurance typically includes general liability and professional indemnity policies tailored to protect the business from various risks and liabilities.

How can bundling general liability and professional indemnity policies save costs for LLC owners?

Bundling these policies often leads to cost savings as insurance providers offer discounts for combined coverage, making it a cost-effective solution for LLC owners.

Is professional indemnity insurance more crucial than general liability insurance for LLCs?

While both types of insurance are essential, professional indemnity insurance is particularly crucial for LLCs offering services or advice, as it protects against claims of negligence or errors.